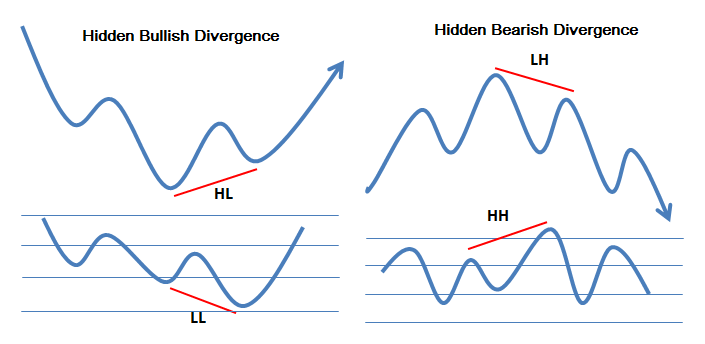

Ok, Let's start with the most obvious question and find out what RSI Divergence is and what trading signals we can derive from it. When the price action and RSI indicators aren't in line, a divergence can be seen on the chart. In an economy that is in a downtrend, Price makes a Lower low. However, the RSI indicator has higher lows. A divergence is the time when an indicator does not agree with the price action. This should be an indication that you must pay close attention to the market. The bullish RSI and the bearish RSI divergence can be easily evident on the chart. The price movement was actually reversed by both RSI Divergence signals. Let's get to one last subject before we move to the topic that is exciting. Have a look at the most popular forex trading for website info including forex backtesting, backtesting tool, bot for crypto trading, forex backtesting, automated trading bot, best forex trading platform, trading platform, stop loss, forex backtesting, RSI divergence cheat sheet and more.

What Can You Do To Analyze The Divergence Of RSI?

We utilize the RSI indicator to detect trends that are reversing. It is essential to determine the correct trend reversal. In the beginning, we must have an upward trending market. Then , we can use RSI divergence to identify weakness. Once that information has been identified and analyzed, we can utilize it to identify the trend reverse.

How To Detect Rsi Divergence During Forex Trading

At the start of the trend at the beginning of the uptrend, both RSI indicator and Price Action did the exact similar thing, forming higher highs. This indicates that the trend is stable. The trend ended with Price hitting higher levels at the conclusion. However, the RSI indicator reached lower highs. This indicates that this chart is one to watch. This is why it is important to pay attention to the market. The indicators and price movement are not on the same page and could be a sign of an RSI Divergence. In this instance it is the RSI divergence is a sign of a bearish trend change. Take a look above at the chart to see the changes that occurred after the RSI diversification. You can see that the RSI divergence is highly precise when it comes to identifying trend reversals. But how do you actually spot an underlying trend? Let's take a look at four strategies for trade entry that can be used in conjunction with RSI Divergence to offer more reliable entry signals. Read the top backtesting tool for site tips including forex backtesting, RSI divergence, automated trading, backtesting tool, automated trading software, software for automated trading, crypto trading backtester, forex trading, automated cryptocurrency trading, crypto trading bot and more.

Tip #1 – Combining RSI Divergence & the Triangle Pattern

Two variants of the triangle chart pattern are offered. The pattern of the ascending triangle is used to reverse a downward trend. The second variation is the descending triangular pattern, which is employed in markets that are in an uptrend to act as an inverse. Have a look at the pattern of descending triangular as depicted in the forex chart. Just like the previous example when the market was in an uptrend and then the price began to decrease. RSI also indicates divergence. These clues indicate the negatives of this trend. We know now that the uptrend is losing momentum. The price formed a descending triangle pattern due to this. This even confirms the reversal. It is now time to execute the short trade. Similar to the previous example we utilized the same breakout strategies to execute this trade too. Let's now move on to the third technique for trading entry. This time , we'll pair trends with RSI diversion. Let's now see how to trade RSI diversion in the event that the trend structure is changing. See the top forex backtesting for website tips including divergence trading forex, forex backtest software, bot for crypto trading, trading divergences, RSI divergence cheat sheet, forex backtest software, automated cryptocurrency trading, trading platforms, forex backtesting software, trading platform and more.

Tip #2 – Combining RSI Divergence and Head and Shoulders Pattern

RSI diversification can be a valuable tool for forex traders to identify market reverses. What happens if we combine RSI divergence along with other factors that can cause reversals, such as the Head pattern? This can increase the chances of trading. Let's explore how to make the right timing trades using RSI divergence in conjunction with the head-shoulders pattern. Related To: How to trade the Head and Shoulders pattern in Forex. A Reversal Trading Strategy. We must ensure that the market is in a favorable state prior to making a decision on trading. The markets that are trending are the best as we are seeking an inverse trend. Check out the chart below. Follow the best forex backtesting for blog examples including best trading platform, best crypto trading platform, forex backtesting, backtester, divergence trading forex, best forex trading platform, RSI divergence, cryptocurrency trading bot, trading platform, backtester and more.

Tip #3 – Combining RSI divergence with the trend structure

Trends are our friends, isn't it? Trends are our friends as long as it's trending. However, we must trade in its direction. This is how professionals teach us. The trend won't last for a long time. It will turn around at some time. Let's look at the structure of the trend, RSI Divergence and how to spot those reverses. As you are aware, the upward trend is forming higher highs while downtrend is creating lower bottoms. The chart below illustrates this point. If you look at the chart to the left, you'll notice that it's a downtrend. It is a series with lower highs and higher lows. Next, have a look at the RSI divergence that is highlighted on the chart (Red Line). Price action causes Lows however the RSI create higher lows, right? What does this all mean? While the market may be creating low , the RSI is doing the exact opposite thing. This indicates that the ongoing downward trend is losing momentum. We should be preparing for a reversal. Read the best crypto trading backtester for more advice including automated trading bot, forex backtest software, backtesting trading strategies, forex tester, backtesting strategies, best crypto trading platform, backtesting, crypto trading backtester, best trading platform, backtester and more.

Tip #4 – Combining Rsi Divergence Along With The Double Top & Double Bottom

Double-bottom is a reversal chart which develops after a lengthy move or the emergence of a trend. The double top is the first top appears when the price is at an unattainable level that cannot be broken. After reaching that level, the price will retrace slightly and then return to the level it was at. If the price bounces off the level, you'll have a DOUBLE top. Below is an example of a double top. It is evident in the double top that both tops were created following a powerful move. It is evident that the second top is not able surpass the first. This could be a sign of an inverse. It is telling buyers that they struggle to keep going higher. The double bottom uses the same techniques, but in a different way. Here, we use the strategy of breakout trading. In this instance we are able to sell the trade once the price breaks below the trigger line. The price fell below the trigger line, and we executed a sell trade within a day. QUICK PROFIT. Double bottoms can be traded with the same methods. Take a look at this chart to understand how you can trade RSI divergence and double bottom.

This isn't the most effective trading strategy. There is no one trading method that is flawless. Each trading strategy comes with losses. This strategy lets us earn consistent profits, however we are able to manage risk effectively and a way to quickly reduce our losses. It will help reduce the drawdown and provide huge upside potential.